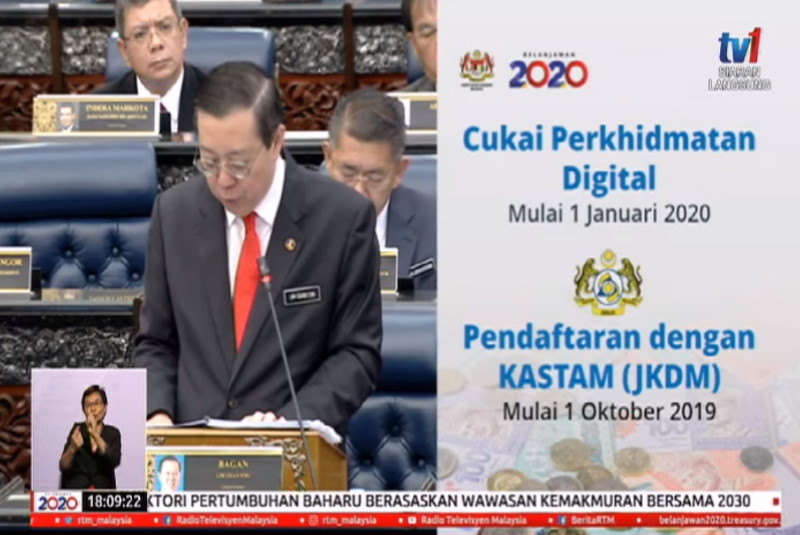

During the tabling of Belanjawan 2020, the Digital Services Tax, which was originally announced in the previous Belanjawan made yet another appearance although very briefly. Once again, Finance Minister, Lim Guan Eng has reminded everyone that the tax will be in effect starting from 1 January 2020.

In addition to that, the minister has also pointed out that foreign service providers are already able to register themselves with the Royal Malaysian Customs Department (RMCD) since 1 October 2019. Last week, the Deputy Finance Minister, Amiruddin Hamzah has stated that the Ministry of Finance is quite confident that foreign service providers will be providing their full cooperation in regards to the new tax, in order to maintain their reputations over there.

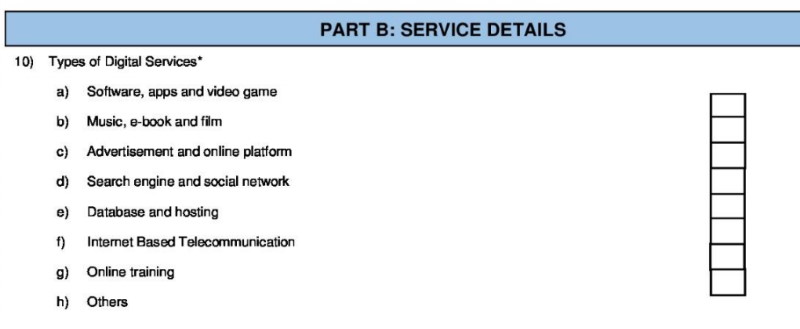

As for the actual tax rate, these digital services will be subjected to six per cent tax. Here are the types of digital services that will be taxed according to the registration form on RMCD’s website:

All in all, it looks like the tax will be imposed on a broad range of digital services. Despite the confidence shown by the Ministry of Finance, we have yet to hear any comment from well-known online service providers regarding the tax.

All in all, it looks like the tax will be imposed on a broad range of digital services. Despite the confidence shown by the Ministry of Finance, we have yet to hear any comment from well-known online service providers regarding the tax.

Hence, we all still in the dark when it comes to the actual costs to consumers once the new Digital Services Tax is in effect. Hopefully, the authorities and service providers will be able to shed more light on the subject way before 1 January 2020.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.