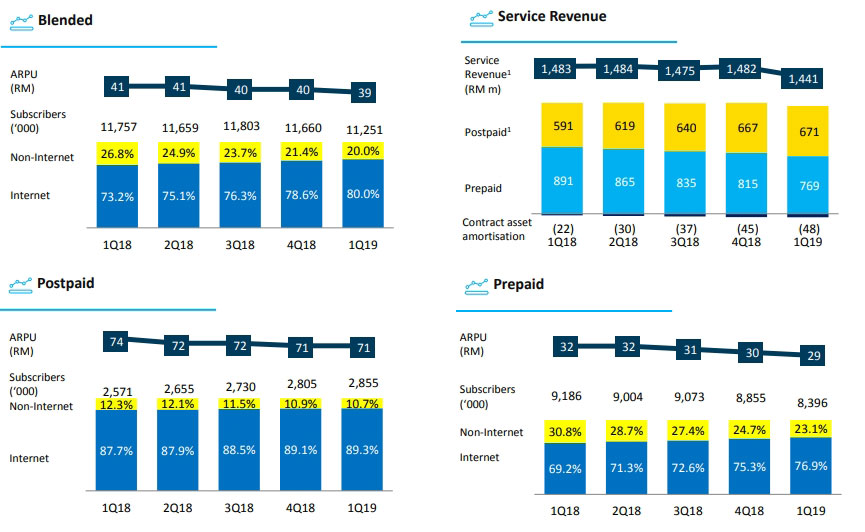

Mobile service provider Digi lost close to 459k prepaid subscribers in the first quarter of 2019. According to their 1Q19 financial results released last week, their combined subscriber base as of March 2019 now stands at 11.25 million, down from 11.66 million as of December last year.

Their postpaid subscribers base, meanwhile, grew by 50k subscribers during this period but did little to alleviate the huge number of prepaid drop-offs – who are very likely to have ported out to a different Telco.

Digi’s combined revenue for the first quarter of 2019 was also down 9.9% compared to the previous quarter, and 7.4% compared to the corresponding quarter last year. Their sales of mobile devices also took a significant hit in this period.

On a slightly positive note, Digi posted a healthy increase in Internet revenue, as well as a higher average data consumption per user in this quarter. The MyDigi app monthly active users also climbed up to 3.2 million with 21.0 million upsell transactions for the quarter recorded on the app.

Digi 1Q 2019 Financials:

| RM million | 1Q19 | 4Q18 | Q-o-Q | Y-o-Y |

| Total revenue | 1,509 | 1,674 | (9.9%) | (7.4%) |

| Service revenue | 1,441 | 1,482 | (2.8%) | (2.8%) |

| EBITDA (boi) | 723 | 740 | (2.3%) | (6.7%) |

| EBITDA margin | 48% | 44% | 3.7pp | 0.5pp |

| PAT | 366 | 378 | (3.2%) | (5.2%) |

Key Highlights (Y-o-Y), according to Digi

- Service revenue at RM1,441 million fuelled by solid postpaid and internet revenue growth

- First interim dividend of 4.3 sen or RM334 million, payable to shareholders on 28 June 2019

- Internet revenue grew 13.3% y-o-y to RM862 million

Postpaid revenue1 grew 13.5% y-o-y to RM671 million over a larger 2.9 million subscriber base - Prepaid revenue moderated to RM769 million; more importantly, prepaid subscriber mix shifted to 52% internet vs. 48% voice base setting the foundation for sustainable growth for the future

- OPEX reduced 0.4% y-o-y from solid efficiency initiatives, opex to service revenue healthy at 35.2%

- EBITDA stood at RM723 million or 48% margin

- Profit After Tax (PAT) at RM366 million with 24% margin

- Ops cash flow moderated 6.6% y-o-y but improved 8.8% q-o-q to RM555 million or 37% margin due to investments in IT and network upgrades

- Net debt to EBITDA ratio healthy at 0.8 times while conventional debt over total assets steady at 21%, well within the Shariah threshold

Source [MalaysianWireless] via [Digi 1Q19 Financial Report]

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.