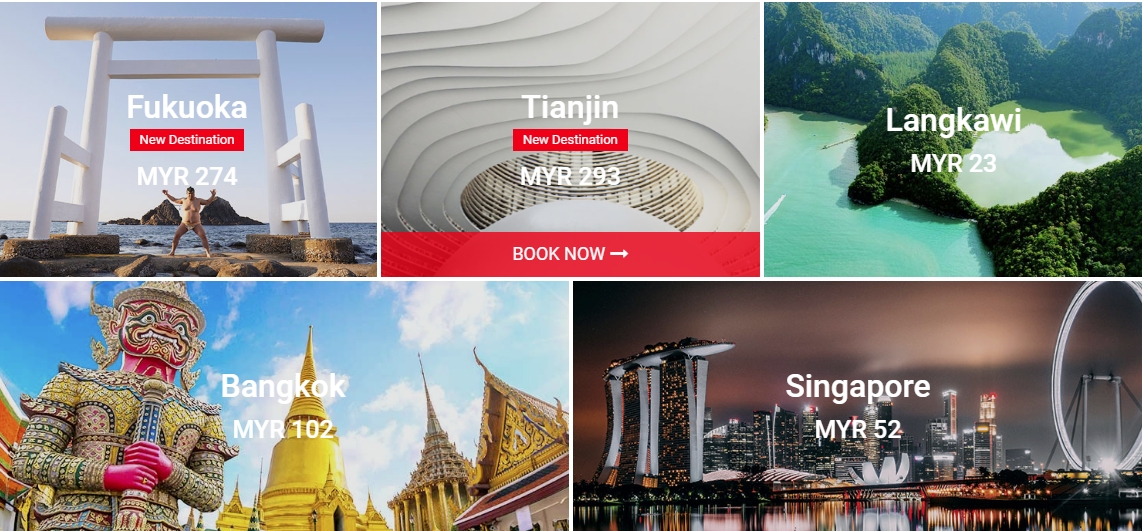

The Malaysian Aviation Commission (MAVCOM) has slapped a RM160,000 fine on both AirAsia and AirAsia X for advertising misleading ticket prices. This fine includes advertisements and promotions places across the Internet, as well as on their respective websites.

The penalties, which only takes into account misleading air ticket prices published for the 2nd quarter of this year, has been paid in full by both airlines. The non-compliance comes under the Malaysian Aviation Consumer Protection Code (MACPC), which came into effect in 2016. Under the MACPC regulations, an airline must indicate the final price of airfares to be paid to the airlines, including taxes, fees, charges and surcharges that are unavoidable at the time the advertisement is put up.

“The MACPC untimately provides for more transparency on aviation service providers’ obligation towards consumers rights and interest as air travellers.”

MAVCOM

A quick check on AirAsia.com confirms that the published base price for air fares today are inclusive of all unavoidable chargers. Credit card and Bank surcharges are however not included in the base fare, and will be added in during checkout.

Prior to this, AirAsia was fined AUD200,000 in Australia for not including taxes and charges in their advertised air fares. AirAsia, on that occasion also pleaded no contest to the breach and paid the fine.

Prior to this, AirAsia was fined AUD200,000 in Australia for not including taxes and charges in their advertised air fares. AirAsia, on that occasion also pleaded no contest to the breach and paid the fine.

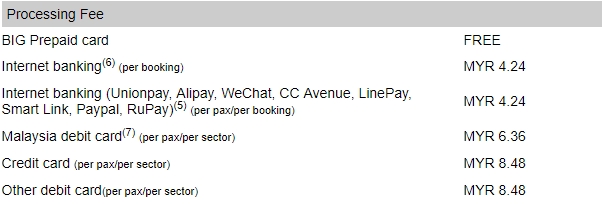

Processing Fees for Payment Methods

AirAsia and AirAsia X however still continue to impose a ‘processing fee’ on almost all payment methods, inclusive of Internet Banking, credit as well as debit cards. The only method that is exempted from these fees is AirAsia’s own BIG Prepaid Card.

Bank Negara Malaysia earlier this year has clarified that retailers are not allowed to impose any surcharges for payments using debit cards. What is even more strange is that the fees for debit and credit cards are charged individually for each traveler instead of on the total booking amount.

Only payments via Internet Banking is charged based on the total booking amount, however even this charge remains questionable as Malaysian Banks have started to waive the IBFT (Interbank Fund Transfer) Fees since June of this year.

Only payments via Internet Banking is charged based on the total booking amount, however even this charge remains questionable as Malaysian Banks have started to waive the IBFT (Interbank Fund Transfer) Fees since June of this year.

via The Edge Markets, News.com.au

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.