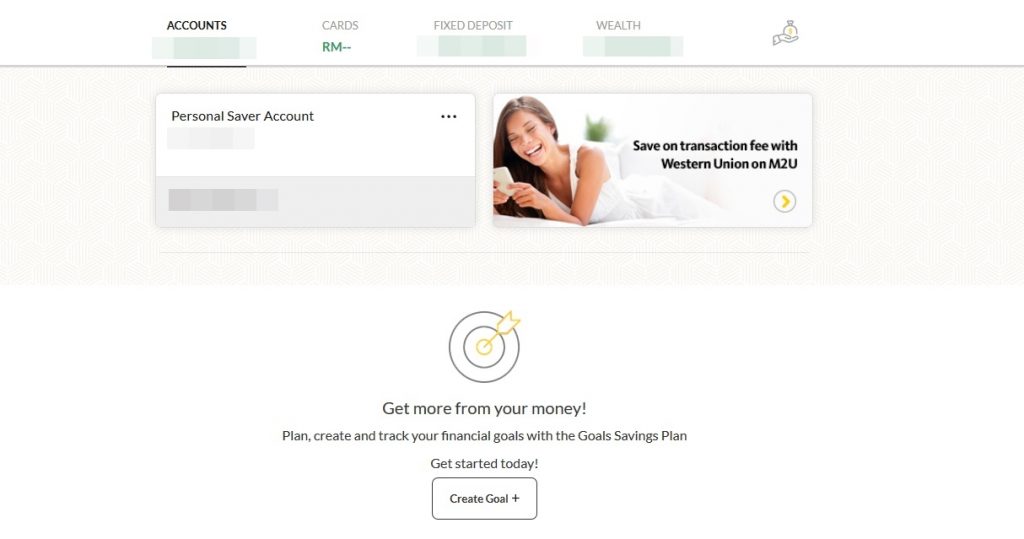

The Maybank2U app has been improved over time, and it is now a very convenient tool for you to keep track of your finances, as far as the bank is concerned anyway. With that in mind, we learned of new features that has been added to the Maybank2U site as well that will not only help you achieve your savings goals more easily, but also track your wealth.

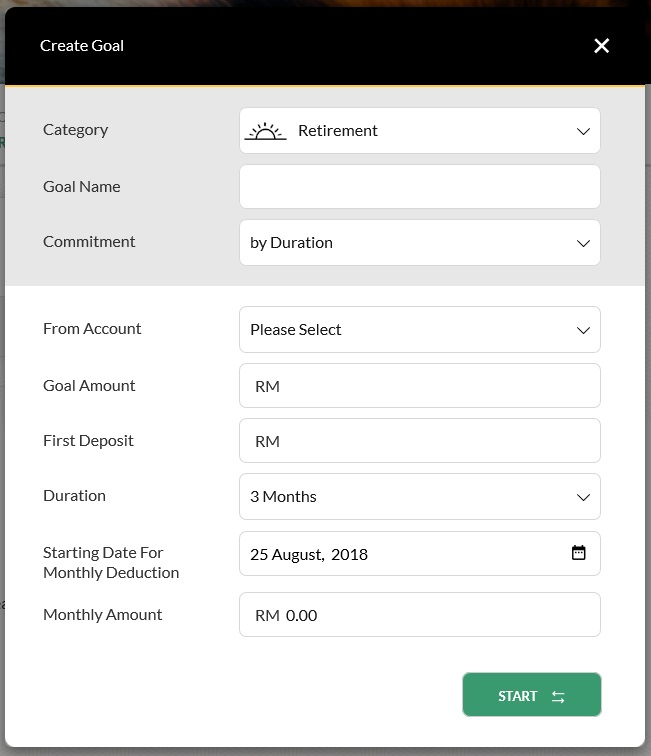

Most prominent among the new features is the Goals Savings Plan. If you have trouble committing to saving a specific amount for a big purchase, then this is definitely the feature for you. You can set up to five goals, which you can then categorise and name as you desire. You can also set the duration for the goal that you wish to achieve, or the amount you’re committing monthly. The duration can range anywhere from three months to 10 years, while the minimum monthly commitment is RM1.

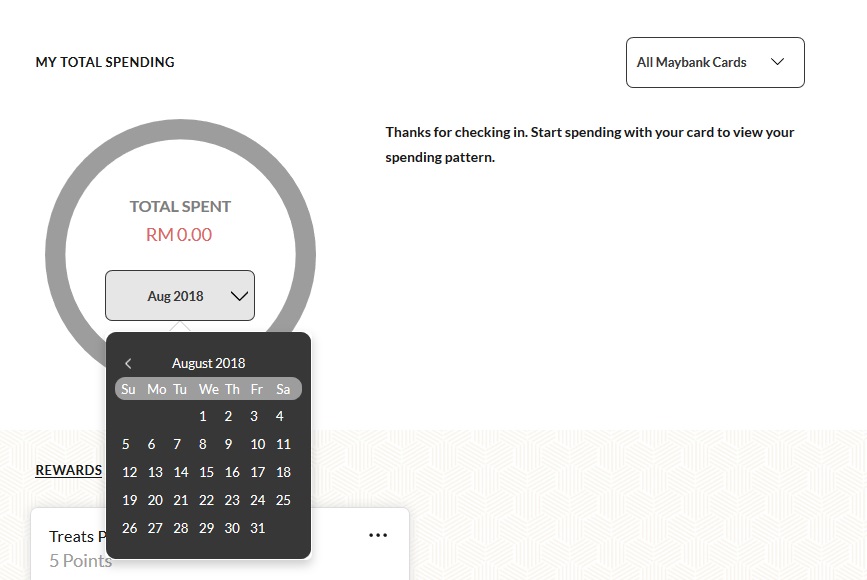

Another new feature is the ability to track your spending through your Maybank cards. Every month, you get a detailed breakdown of the amount you’ve spent, and where you spent them at. You can even go back a few months just to see if your spending habits have changed. If you’re using the Maybank2U app, you can also set spending limits to your cards, going over which you’ll get a notification of the fact through the app.

The final feature is the ability to track non-current assets, such as trust funds and shares. The breakdown shows the value of each item you own, and the percentage it makes up of all your total wealth. Of course, not everything will be listed here.

Maybank has said that not all of these features will be making their way to the mobile app. This is because they are more things that you take a glance at when at home than features you’ll actively need to use when you’re out and about. That said, there are some exceptions, like the Goals Savings Plan, that may make its way to the app, if it is deemed to be something that users would appreciate being available when on the go.