Crowdfunding is an excellent online initiative which has helped countless people and organisations reach their goals, and dreams, simply by harnessing the spending power of the masses to contribute to a common goal. But it does not work for everything under the sun, like solving the National Debt of Malaysia.

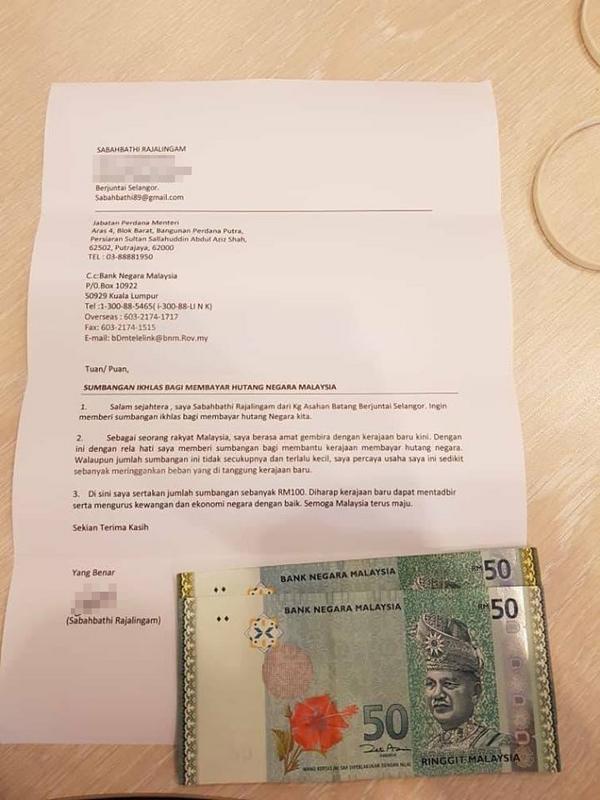

The recent revelation of Malaysia’s whopping 1 trillion debt figure has prompted some individuals to turn to crowdfunding as a way of getting Malaysians together to pool their spare change to be handed over to the government. The rational is that it will help the country to alleviate the national debt issue. Some individuals have also started sending RM100 to Bank Negara to do their small part to help. A number of newly elected MP’s have also come out and pledged their first salary to help alleviate the debt.

While these are all noble, patriotic and commendable in nature, none of it is going to be of any help if you look at the sheer scale of things. We are going to follow our newly minted Finance Minister, Lim Guan Eng and just call a spade a spade here.

National Debt Clock puts Malaysia’s current debt today at around RM708 billion. These is not inclusive of the additional commitments that brings the total to over RM1 trillion, but we shall stick to it as our main debt value. At RM708 billion, the interest alone works out to around RM26 billion a year. To make things a little more clear, the interest on our debt grows at an average rate of RM849 every second.

So, even if we are able to crowdfund, or every one of us chips in RM100, we will need to be collecting RM849, every second of every day, just to service the interest on the debt. The principal debt will not even be paid for even if by some miracle we do achieve this rate.

So, can we please stop with crowdfunding, or asking our dear Tun Dr Mahathir to set up an account for donations, or even start sending RM100 to Bank Negara, because its not even going to cause a dent to the National Debt value.

So what should we do to help?

Pay your taxes

Its quite unfortunate that the filing date for taxes for this year is over. For 2018, we should all file our taxes early, and when possible try not to make excessive claims for relief. This will directly increase government coffers. This way, with the additional funds, the Government will be able to address some of the debt imbalance. It is also an easy way to ensure your contributions to the government reaches them directly.

Buy Malaysian, and Cuti Cuti Malaysia

Instead of buying imported products, switch back to buying products that are made in Malaysia. This will directly stimulate local goods production, and generate a fair amount of profits for local industries. These industries will then contribute their fair share of taxes from their profits back to the government coffers.

Also start visiting more local destinations for the holidays. Spending on local destinations instead of overseas destinations will help grow the local tourism industry which has been struggling of late.

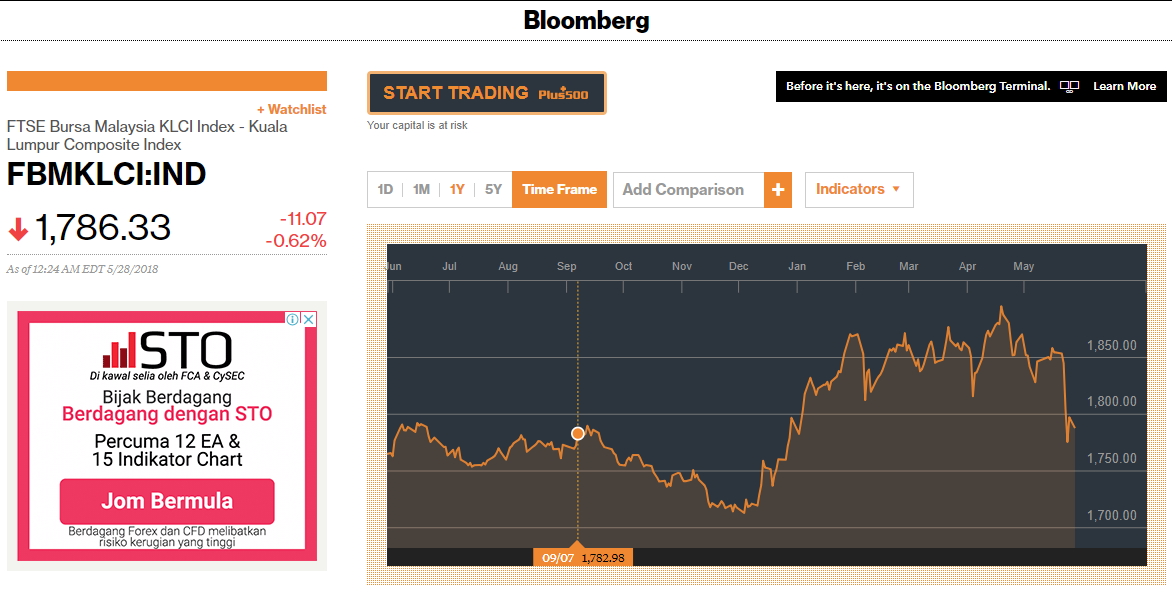

Invest in the KLSE

Over the last few weeks, the Kuala Lumpur Stock Exchange (KLSE) has been taking a hit, mainly due to the new government becoming transparent, and proverbially ripping off the band-aid from the previous regime. This has led to a lot of foreign investors getting spooked and withdrawing foreign investments from the local market.

While this knee jerk reaction might be a bad thing for the market, it will eventually be a good thing for most of us Malaysians. If you have the money to spare, start investing some of it in the KLSE, and you will help propel up the market, and probably make a decent profit in the coming months when the foreign funds start flowing back in.

Unlike a few years ago, investing in the stock market these days is pretty easy and straight forward. If you’re 18 and above, you can start investing in the KLSE within 48 hours, without ever having to leave your home. There are many reputable online trading platforms that help you get everything done with very little hassle. Funds top up and withdrawal are all done via your preffered online banking platform. We highly recommend Rakuten Trade’s platform at https://www.rakutentrade.my for its easy of sign up as well as a very simple and intuitive platform for beginners.

The big bad GST

Perception is everything, and in the case of the Goods and Services Tax (GST), the timing of its implementation, as well as the lack of understanding easily made it Public Enemy Number 1. When you implement a new tax system (no matter how good it really is), at the same time when a massive billion ringgit global scandal like the 1MDB is exposed, you know its going to cop the blame for everything, and so it did.

The implementation was abrupt and sudden, the lack of planning confused the public, and some even took advantage of the bad light the GST was getting to increase prices, and push the blame to GST.

GST will be zero rated in June, and we are still not sure what will happen to it later this year. But, if you are sincere about helping Malaysia out of this difficult times, we should give GST a proper chance. Implemented correctly, and with proper check and balances by a commited government, GST will benefit the entire country in the short and long term.

So there you have it, some of the simple ways you can start contributing and showing your patriotism to our great country, Malaysia.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.