Whether you’re planning on getting a new gaming rig or just thinking about upgrading your graphics card, this is perhaps the worst time to do so. What’s even worse is the fact that this may be the case for the foreseeable future.

The prices of graphics cards from both Nvidia and AMD have been on a steep upward trend. For example, at the time of launch, a GeForce GTX 1060 6GB had a local MSRP at around the RM1500 mark, while a Radeon RX 470 could be found for around RM1000. Today, the price of those cards have soared far higher than that, with the cheapest custom-cooled variants going for just below RM2,000 – that’s a 30% to 100% jump in prices.

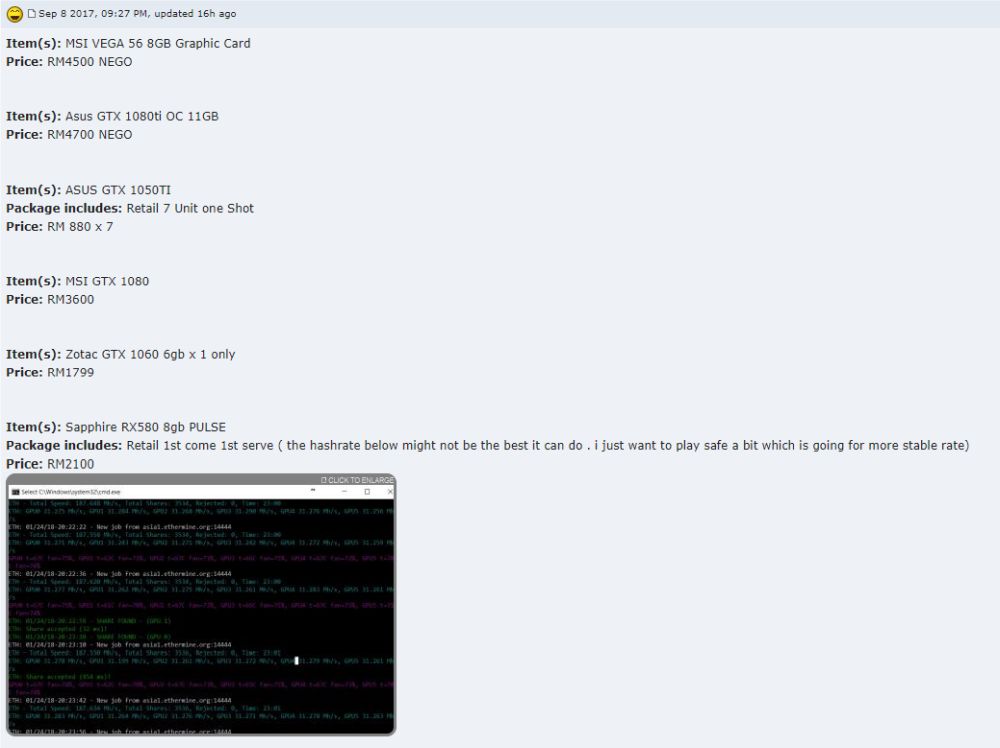

It’s the same story with the high-end and enthusiast-grade models: if you’re able to find either a GeForce GTX 1080 or a Radeon RX Vega 56 for anything less than RM4,000, you’re still paying too much for the card. The same goes for any and all custom-cooled GeForce GTX 1080 Ti graphics cards.

So then, the obvious question to the situation is this: what exactly is driving these prices up so high, it’s forcing gamers to take a rain check on building their dream rig?

Cryptocurrency mining

Yes, cryptocurrency mining is the first and most obvious of all the reasons behind the shortage of graphics cards. Despite the existence and availability of dedicated ASIC miners from companies such as AntMiner and Baikal, there’s still a majority of people who prefer using a GPU-powered miner to earn their digital dollars.

Bear in mind: these entities don’t just buy one or two cards at a time; they literally buy the cards in bulk. Take a stroll down to either Digital Mall in PJ or Low Yat Plaza in KL and walk in to any computer store that sells PC components, and chances are that you’ll see rows of graphics cards that are fastened to a rudimentary skeletal frame and plugged into a bare bones system.

These are essentially GPU mining rigs that are built to order for the company, with a minimum cost for one rig starting at around RM12,000, and that’s just for a system with six cards.

It’s this mass purchases that have caused resellers and distributors to jack up the price of all graphics cards they bring in. The demand for GPUs are currently at an all-time high, and what’s happening is a classic exercise in the basics of economy. There is a huge disparity between demand and supply, resulting in whatever stocks of GPU that are available to be priced higher than normal.

Another reason why people favour GPU mining to ASIC mining is contingency. If a GPU miner should one day decide to exit cryptocurrency mining, they can simply sell their GPUs and recoup – or even profit from – the initial outlay. Given the high prices of brand new GPUs, prices of second-hand GPUs are also soaring.

Global memory shortage

That being said, cryptocurrency mining isn’t the only reason behind the rising prices of graphics cards. There is a serious shortage of memory chips globally, and this isn’t exactly a new issue either: signs of the shortage can be traced back all the way to 2016, when it first began affecting SSD and RAM manufacturers, before ultimately affecting the GPU market today.

And it’s not just memory chips that are limited today either. GPU makers are also complaining of a shortage of MOSFET transistors, an important component in a graphics card. But what, and to a greater extent, who is causing this memory shortage?

The ‘who’ portion points to some of the world’s major internet and tech companies. Facebook, Amazon, Google, and even China-based companies such as Baidu have been buying up large amounts of memory chips. As for ‘what’ they need it for? All that memory is being used to expand their ever-growing hyperscale data centers. With big data processing being ever so rewarding to these companies, no change is spared to collect and store as much data as they can.

And because of this, manufacturers are struggling to scale production to cater to both enterprise and consumer markets. With enterprise sales usually tied to long-term contracts or bulk purchases, it makes more financial sense to cater to enterprise businesses.

So where should the consumer turn to?

Used GPUs and its risks

The second-hand market is always a popular place to get some potentially good bargains, provided the buyer is comfortable with the risks associated with buying a used product. The Lowyat forums is a hugely popular example, where many individuals use the platform to sell off their used electronics.

But as mentioned earlier, the rising prices of new GPUs are also causing a sharp increase in used GPU prices as well. Some enterprising individuals have also taken advantage of the situation. Like miners, these people buy up GPUs that they can find – new and old – in bulk, and then proceed to resell them at a premium.

But it isn’t these resellers who you should be most wary about purchasing from – it’s actually buying from miners that you should really be careful about. Buying a graphics card that was previously used for mining is usually a bad idea. Not all miners reveal the current state of the card at sale; they can tell you that it was used for mining, but what they would be reluctant to disclose to you is just how long the card was used for that purpose.

GPU mining puts a heavy strain on the graphics card. Unlike gaming, a GPU used for mining is made to constantly perform under a full load. Doing this increases the wear-and-tear of the card, thus shortening the lifespan of the card faster than usual. This is why some brands do not honour warranty claims for cards used for mining, and a strong reason why you shouldn’t buy a second-hand GPU that was used for mining.

So when is a good time to buy a GPU?

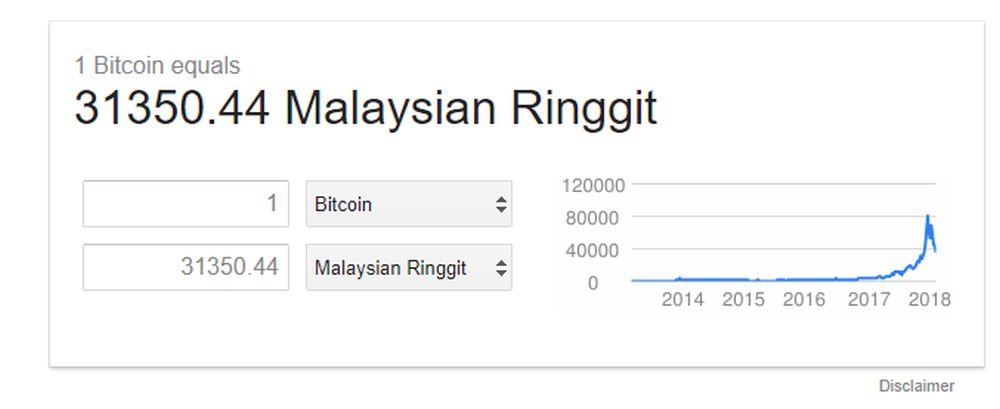

As much as we hate to say this, it doesn’t look like there is any end in sight to the GPU shortage conundrum. As it stands, the value of GPUs are indirectly pegged to the value of popular cryptocurrencies like Bitcoin, which now hovers at the RM33000 mark – well below the peak of about RM80000 in late 2017.

While the drop in its value may be a good thing for gamers, because of Bitcoin’s volatility, there’s no telling if the value of the coin will continue its downward spiral of when it will rebound. But, it’s very unlikely miners will stop buying up the cards, simply because they’ll still want to keep hoarding as many of those crypto dollars as they can.

GPU makers are addressing the issue, with Nvidia reportedly ready to ramp up production of its cards, as well as reportedly asking retailers to sell their cards to gamers, and not miners. Meanwhile, AMD pitched a hardware site to demonstrate if its flagship Threadripper CPUs are actually good for mining. The answer is mixed: yes, it can reportedly pay for itself in 18 months, but it is not as efficient as mining with GPUs, where a single system can hold multiple GPUs (versus just one CPU per system).

If, at this stage, you really need to get a graphics card, you’re in for some tough luck. You’ll either need to pay the premium to purchase a product that’s in spectacular demand, or bear the risk of getting a second-hand card. There is also the option of buying a gaming laptop, where their prices have not (really) been affected by increased GPU prices – but you will have to pay the “portability” premium; a laptop will usually cost more than a comparably-specced desktop.