Bank Negara Malaysia (BNM) wants to push Malaysians towards electronic banking, and e-payments in general, by waiving the instant transfer fee for online transactions. It is also taking steps to resolve the fragmented QR code payment market by introducing an Interoperable Credit Transfer Framework (ICTF).

Online instant transfers of less than RM5,000 will see the 50 sen fee removed from 1 July 2018, making the option more attractive for individuals and SMEs. This fee removal does not apply to large businesses. This is to encourage locals to turn to online banking, and reduce the reliance on cheques.

Waiving the fee is only the first step in BNM’s three year plan to support businesses and individuals. The e-Payment Incentive Fund (ePIF) is also being expanded to RM198 million in a bid to help merchants migrate to e-payments.

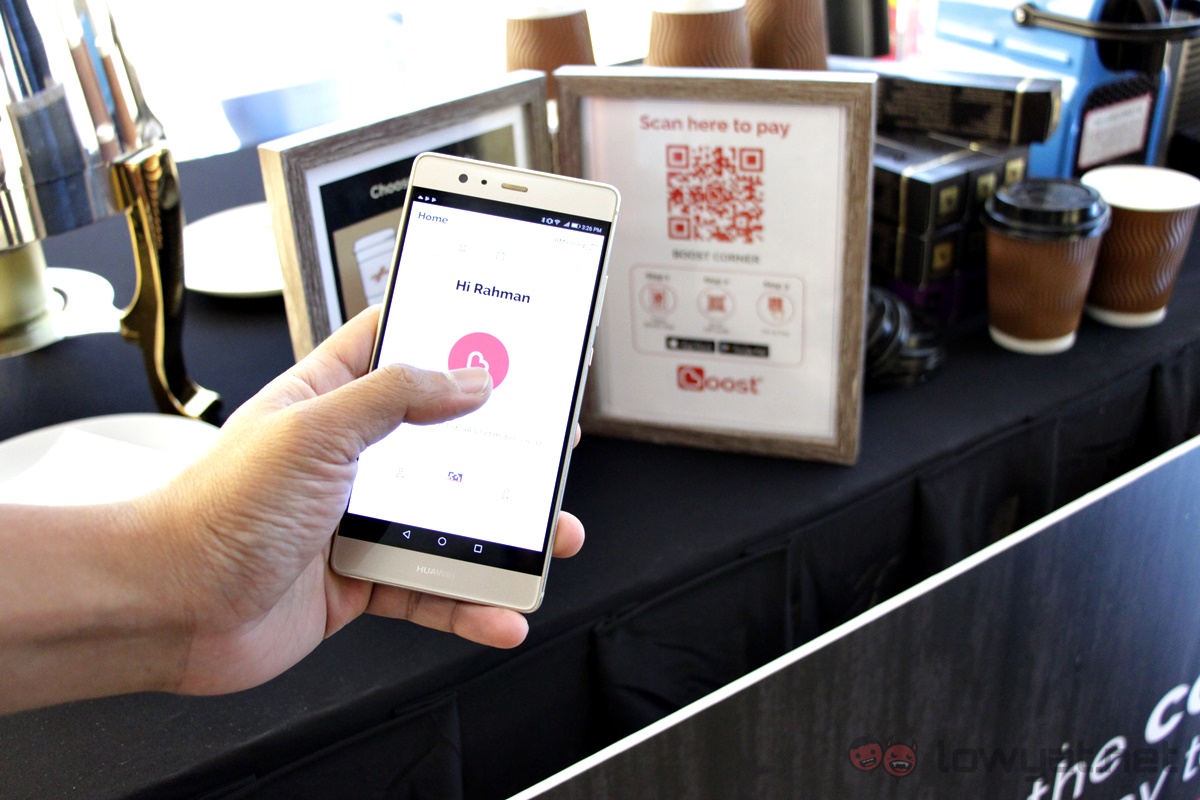

Also more importantly, the ICTF is being set up to streamline the numerous QR code based digital wallets that have appeared in the last year. This framework would connect both banks and non-bank e-money issuers to transfer funds across each other. Essentially allowing making QR codes displayed for payments platform agnostic.

“To encourage QR code payment, avoid market fragmentation and broaden financial inclusion, Bank Negara Malaysia has issued an Interoperable Credit Transfer Framework (ICTF) for consultation. The ICTF aims to connect both banks and eligible non-bank e-money issuers to ensure reachability of bank accounts and e-money accounts,” said BNM governor Muhammad bin Ibrahim.

PayNet, the combined form of MEPS and MyClear, will be in charge of the framework; allowing the digital wallet providers to focus on competing for customers on the basis of “value-added services rather than on the basis of infrastructure.” A move that should alleviate the problem of having so many digital wallets appear within the last three months.

[Source: BNM]

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.