Heads up ecommerce entrepreneurs, digital agencies, social media marketers and anyone who spends on online advertising via Facebook, Google Ads or even on Amazon Web Services.

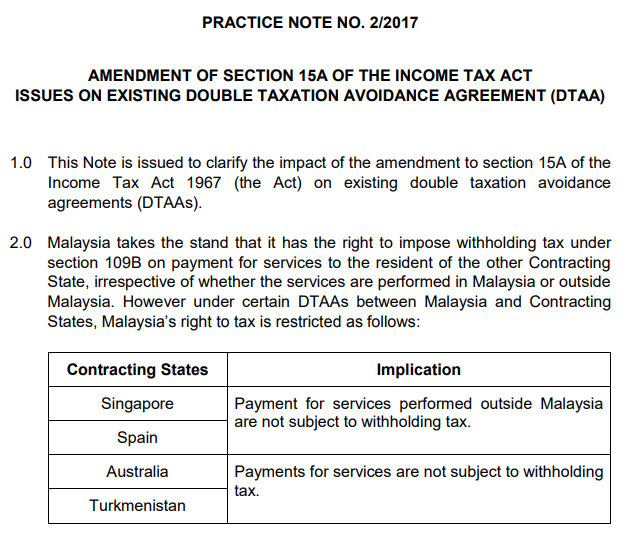

According to CK Wong, co-founder of ecommerce blog ecInsider.my, a recent amendment to the Malaysian Income Tax Act 1967 that came into effect on the 17th of January 2017 will require you to pay Withholding Tax (WHT) on all your tax invoices inclusive of those that are deemed to be rendered offshore.

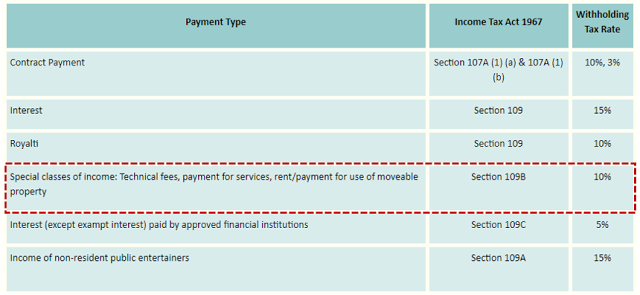

Withholding tax (WHT) is not new, it has always been around and it is applied to a special category of services, which includes but is not limited to advertising, technical services, royalties and such.

Prior to 17th January 2017, WHT only was applicable to onshore services, so if you received services in Malaysia from a foreign company, and you received an invoice for RM100,000, you will pay the said foreign company RM90,000, and you will submit the balance RM10,000 to LHDN. Quite straightforward here.

What has changed after the amendment is that WHT now also applies to offshore services as well. So all payments for services rendered to the likes of Facebook, Google etc will now be also subject to WHT, even if these services were not specifically rendered in Malaysia.

Now here is the catch 22 situation. While you could wire transfer a foreign entity RM90,000 for a RM100,000 invoice – informing them of the WHT deduction , neither Facebook (who will invoice you from Ireland) or Google (who will probably invoice you from Singapore) will accept your RM90,000. You will still have to pay Facebook and Google RM100,000. Does this mean you don’t have to pay WHT, tough luck, you will still be liable for WHT with the new amendments.

So, you now have to fork out RM10,000 from your own pocket to LHDN. Wrong again, you will have to fork out RM11,000 because your tax invoice has now gone up to RM110,000 considering that you have now got to include WHT in it.

We are not going to get into the nitty gritty here because this is not really everyone’s cup of tea and we are no tax experts, but if you would like to get down to the details of the amendment head on over to the original posting at ecinsider.my

Source : ecinsider.my

Article updated. Thanks Voon Seng Yau

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.