After a silent rollout in the beginning of June, FavePay has now been officially introduced to Malaysians. Designed as a mobile payment aggregator, FavePay appears to be a really good first step into encouraging the use of mobile payments in the country.

Fave founder, Joel Neoh, was quick to stress that FavePay is not an e-wallet, but rather an aggregator of mobile payment solutions. This means that e-wallets can integrate their services into FavePay to enable payments to Fave merchants. It already has e-wallet giant Alipay onboard in Singapore, with the promise of more to come in Malaysia.

The problem that FavePay is aiming to solve is the fragmented nature of mobile payment solutions in Malaysia. As mobile payment is still in its infancy here, that’s understandable – there’s Samsung Pay leading the way, but adoption rate for this is still low for a variety of reasons: ecosystem lock (Samsung Pay only works with several Samsung smartphones), merchant take-up, and most importantly, the timid mindset of Malaysians to embrace new technology.

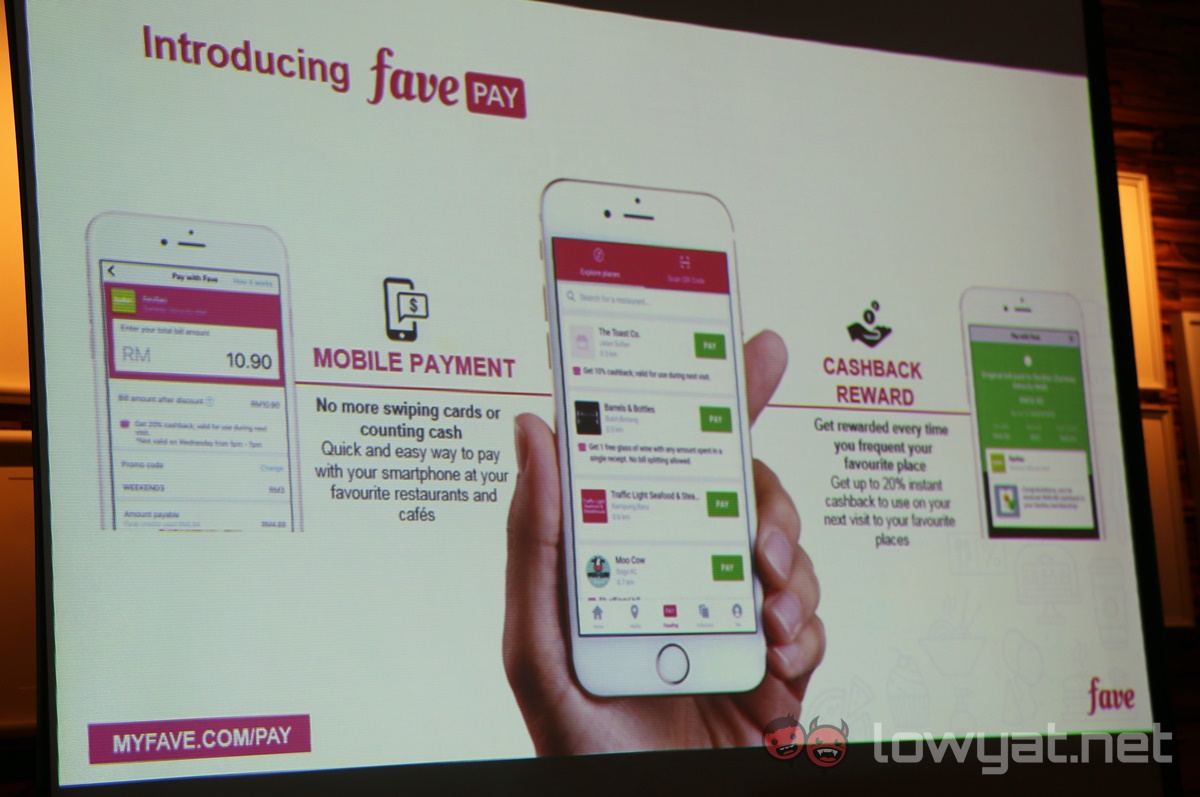

FavePay aims to democratise the mobile payments scene in Malaysia, by lowering the barrier of entry to enable virtually anyone with a smartphone and a credit/debit card to pay using their phones. FavePay is accepted at all merchants partnering with Fave, and the payment option lives within the Fave app, which already has a deals discovery page – making it a one-stop solution for those looking for a good deal. And because it works from within an app, virtually any smartphone with a camera can use FavePay – unlike the NFC-based solutions such as Samsung Pay and Apple Pay.

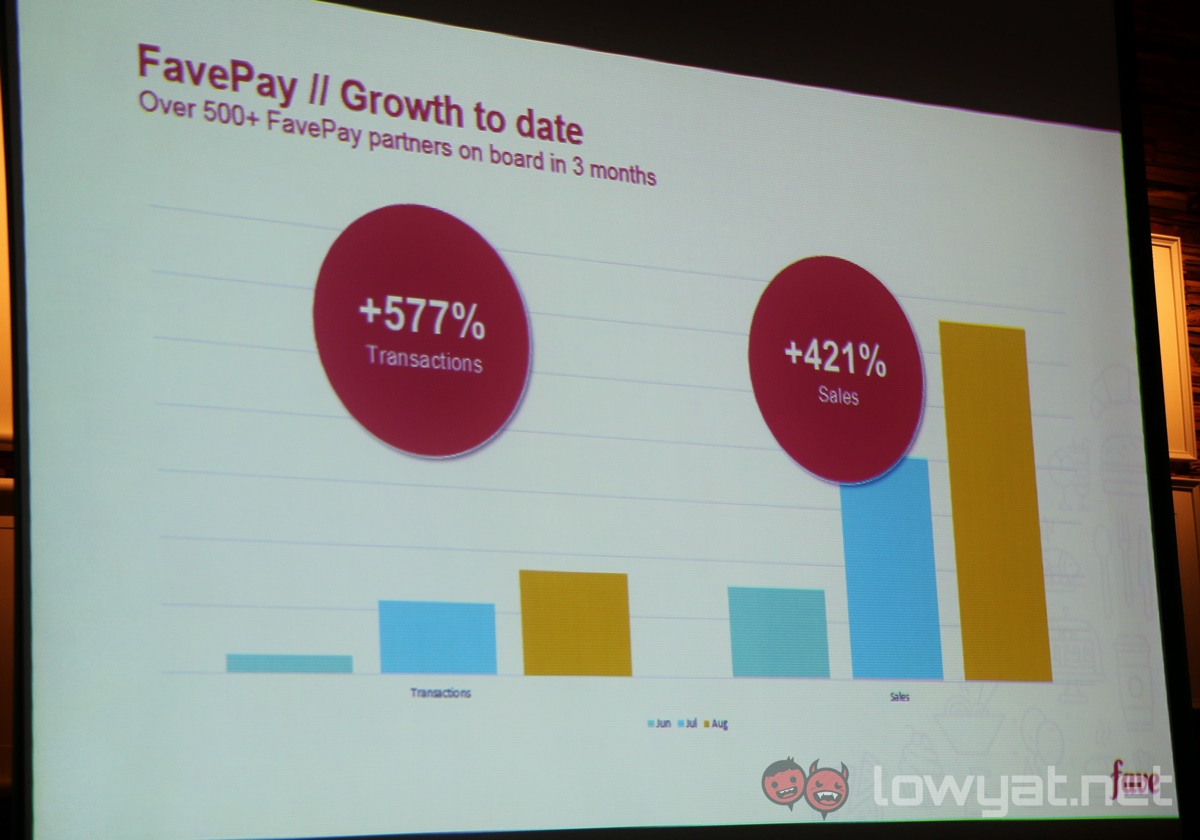

Currently, there are over 500 merchants onboard that accept FavePay, including various popular F&B outlets such as llaollao, Auntie Annes, Juice Works, Mikey’s New York Pizza, O’Briens, and many more. At the moment, FavePay accepts all Visa and Mastercard credit and debit cards, with Alipay support coming by the fourth quarter of this year (though that’s designed more for the influx of Chinese tourists in Malaysia each year).

Besides the convenience and safety of making purchases without taking out your wallet, FavePay is also encouraging users to continue using the platform by offering instant cashback the next time you use the service at the same merchant. For example, if you purchase frozen yogurt from llaollao, you will get an instant 20% cashback the next time you make a purchase there. These discounts are dependent on the merchant, but are designed to reward you for coming back.

Interestingly, despite being in its infancy, the take up and retention rate of FavePay users has been very encouraging. Using llaollao as a case study, Neoh mentioned that not only did the number of FavePay transactions at llaollao grow significantly in the last three months, the retention rate stood at well over 50% – which is a strong evidence not only of the service’s ability to bring back customers to merchants, but also that there is a growing group of people who are confident with using mobile payments right here in Malaysia.

Being comfortable with making payments via FavePay will go a long way into making mobile payments an acceptable form of payment in the country. QR code-based transactions using Alipay and WeChat Pay is essentially a way of life in China, where mobile payment penetration is even higher than many countries in the West. Fave aims to do the same with its service, and by targeting digitally-savvy youths into adopting the technology, it will go a long way into gradually changing the mindsets of Malaysian consumers in the near future.

Local banks are tied down by regulatory bodies before they can roll out similar initiatives, but they will eventually get there (MaybankPay and CIMB Pay are good examples here). Until then, it appears FavePay is laying a pretty solid foundation.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.