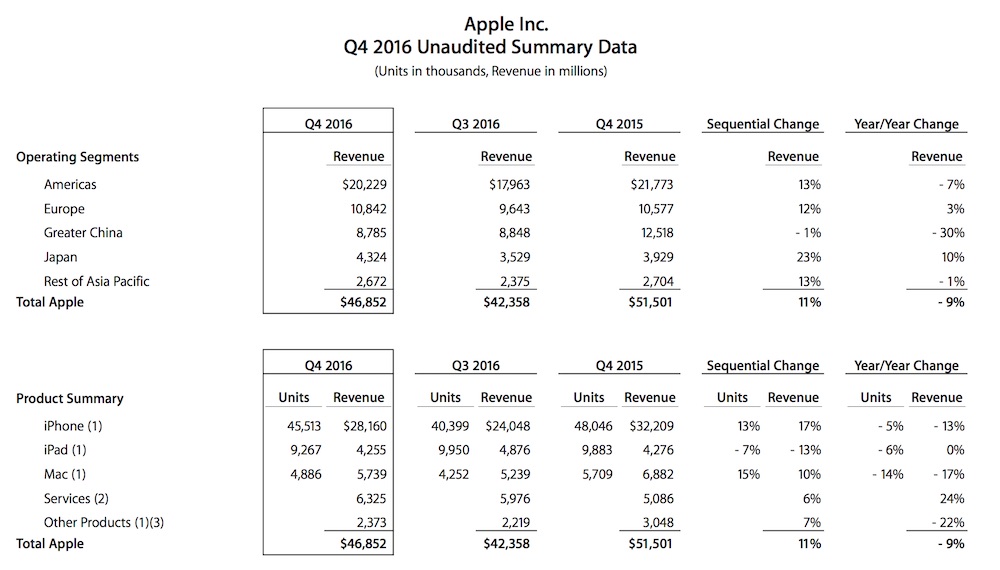

Apple has just released the financial results for its fiscal 2016 fourth quarter that ended on 24 September 2016. The Cupertino company sees its first ever decline in annual revenue since 2001, falling from US$233.7 billion in 2015 to US$217 billion in 2016 fiscal year. As for its quarterly results, Apple sees a revenue of US$46.9 billion and quarterly net income if US$9 billion compared to US$51.5 billion and net income of US$11.1 billion in the same quarter last year.

Apple’s decline could be driven by weak iPhone sales, which sees a 13% drop in revenue (US$28.2 billion in Q4 2016 vs. US$32.2 billion in Q4 2015). Having a similar looking iPhone for the third year in a row could’ve slowed things down a bit for the company though, it’s good to note that the iPhone 7 only went on sales in limited countries for two short weeks before Apple’s fiscal year ended. We have to wait for the next quarterly result to see how the iPhone 7 sales is doing.

As for other products such as the iPad, Mac, Apple TV, Apple Watch and such, they all see a decline compared to the last quarter and year-on-year.

Sadly, Apple’s result groups the Apple TV, Apple Watch, Beats products, iPod and other Apple-branded and third-party accessories under “Other Products”, so there’s no telling on how the Apple Watch sales is doing though, according to IDC, it hasn’t been doing well at all.

But not everything is going down for the company, Apple’s service revenue grew by 24% to set another all-time record. Tim Cook, Apple’s CEO remains positive, calling it a “strong September quarter results”.

“Our strong September quarter results cap a very successful fiscal 2016 for Apple. We’re thrilled with the customer response to iPhone 7, iPhone 7 Plus and Apple Watch Series 2, as well as the incredible momentum of our Services business, where revenue grew 24 percent to set another all-time record.” – Tim Cook, CEO of Apple.

With this financial report, Apple’s guidance for its fiscal 2017 first quarter is as follows:

- revenue between $76 billion and $78 billion

- gross margin between 38 percent and 38.5 percent

- operating expenses between $6.9 billion and $7 billion

- other income/(expense) of $400 million

- tax rate of 26 percent

Visit Apple for the full report.

(Source: Apple via: The Verge)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.