As far as new technology goes, Malaysia is rarely among the first in the world to experience them. New smartphone models usually take their time before arriving here (if at all), while more exciting ones such as mobile wallets are still nowhere to be seen, despite our closest neighbours already enjoying the convenience.

The top three mobile payment solutions, namely Apple Pay, Android Pay, and Samsung Pay, are all still unavailable in Malaysia. And as someone who has experienced mobile wallets being liberally used in cities such as San Francisco and Singapore, I must say we’re missing out on something in our lives.

https://www.youtube.com/watch?v=OueObu2aA_M

Cashless payments are the way forward. It is both safer and more convenient, dismissing the need of carrying thick bulky wallets in favour of slim, minimalist wallets that hold just a few cards. Or better yet, go without one: solutions like Android Pay lets you save everything from credit cards to loyalty cards onto your smartphone.

It’s safer, too: where credit cards can be easily stolen and used, mobile payments require an authenticator (such as a fingerprint or a PIN) before it can be used.

Thankfully, Maybank is pushing the agenda in Malaysia with several initiatives. Its new service, MaybankPay is the country’s first mobile payments solution. It also appears to replace the yet-to-be-available Maybank PayBand, the wearable that’s purpose-built for contactless payment.

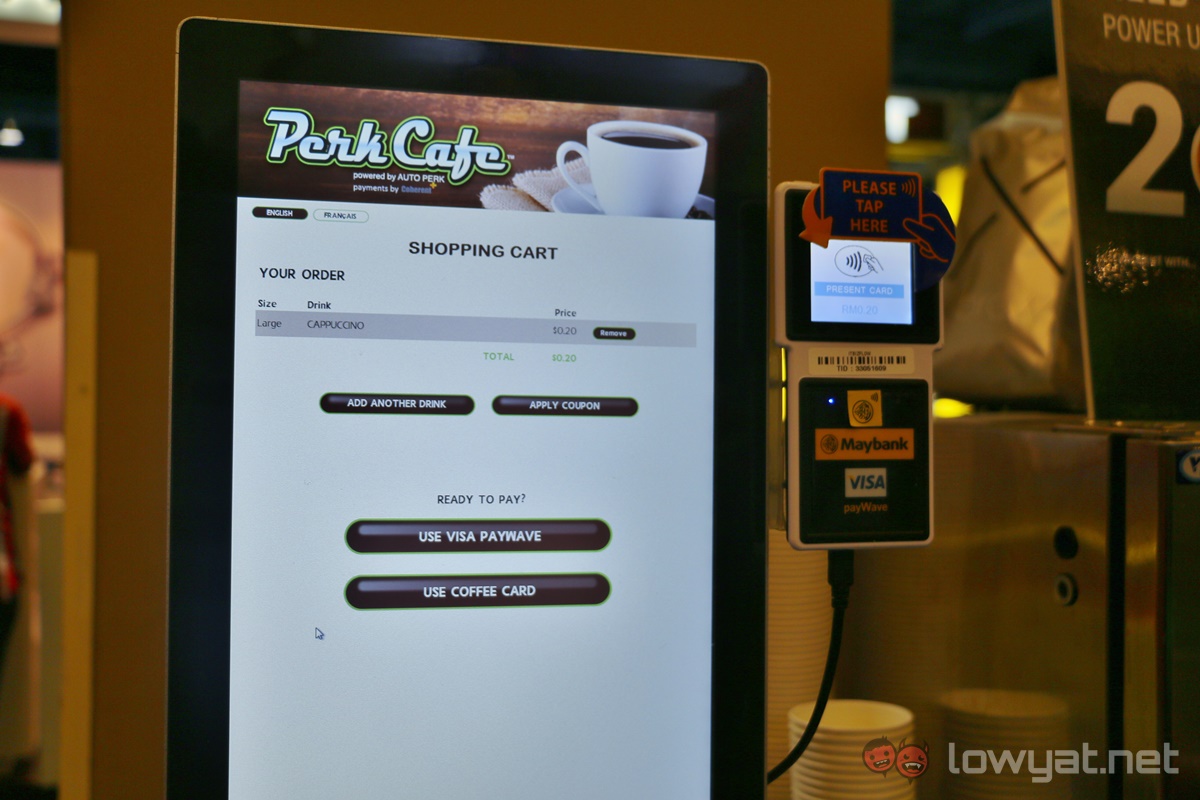

At the ongoing Maybank Treatsfair 2016, I tried MaybankPay for myself; the service will only roll out nationwide in August. Everyone can sign up to be a beta user, and download the app – though for now you can only pay for a 20 sen cup of coffee at the fair.

Given that it leverages on the Visa PayWave contactless terminal, the system is robust and reliable. In fact it took longer for the coffee to be prepared than for the payment to be processed.

The app is very secure – you can’t capture screenshots while you’re in it. To add a card, you’ll need to key it in, and a two-factor authentication SMS will be sent to your phone. Once a card has been successfully added, you’ll then be required to enter a six-digit PIN that you’ll need to key in every time you open the app. If you can’t key that in, you can’t make a payment.

So far, the app does not integrate fingerprint authentication, so you’re stuck with using a PIN for now.

But I do not believe MaybankPay will be a long-term solution for mobile payments in Malaysia, and there are a few reasons behind it.

Firsly, MaybankPay only supports Maybank Visa cards. Sure, the app lets you store up to eight cards, but you’re limited to only Visa credit, debit, and prepaid cards issued from Maybank. If you try to add other cards, the app will not verify it.

Of course, this isn’t entirely surprising, since MaybankPay works via Visa’s PayWave terminals. And while we’re at it, this also means you can’t use MaybankPay at merchants which do not have Visa PayWave terminals.

According to a Maybank representative at the booth, I was told that there are currently around 1,000 merchants nationwide with Maybank Visa PayWave terminals, with the number set to grow.

But the biggest problem does not lie with the list of merchants.

https://www.youtube.com/watch?v=hmT0WGVjT4M

While still not confirmed, we’ve been hearing murmurs that both Apple and Google have been in talks with banks to make their mobile payment services available in Malaysia. An even more concrete plan is from Samsung, which is aggressively pushing Samsung Pay to be faster than Apple and Google.

In fact, a company spokesman confirmed to Lowyat.NET that Samsung Pay will “definitely” be available in Malaysia by Q4 of this year. Given that it will support a variety of cards to be stored, and also support for contactless as well as the more popular magnetic payment terminals, Samsung Pay dwarfs MaybankPay in two important metrics: scale, and third-party support.

What this means is that when Samsung Pay reaches our shores, Maybank will struggle to ensure that its mobile payment solution remains relevant. If I can store my credit and debit cards from various banks, and my Tesco Clubcard or other loyalty cards, within a single app, why should I use another app?

That being said, MaybankPay is by no means a pointless endeavour. If it takes off, it will serve as a useful proof of concept that Malaysians are indeed ready to enter the age of cashless payments.