Around this time last year, I wrote a commentary about how Malaysian telcos were finally offering more competitive plans, and how they can continue to improve. 13 months on, and with Maxis’ latest postpaid proposition in mind, how much have our telcos changed for the better?

As it turns out, the Malaysian telco industry is almost unrecognisable from 2015. As Malaysians continue to evolve into massive data consumers, each of the Big Four – Celcom, Digi, Maxis, and U Mobile – have positioned their products to be more appealing to the data-hungry. At the same time, the price per GB of data has continued to spiral downwards.

The Role of The Underdog

U Mobile’s role cannot be overstated in this. Just as it did last year, the underdog constantly made sure its products undercut the competition, driving prices ever downwards. The Hero P70 postpaid plan, which offers 7GB of data packaged with unlimited calls and low SMS rates, is one such example. As it attempts to aggressively expand its user base, the telco is further sweetening the deal for those who sign up for the P70 plan by giving subscribers 15GB of data until the end of 2016.

Not content with that, U Mobile then introduced the RM50 Hero+ supplementary plan for the Hero P70. It introduced the idea of a shared data pool between the principal and supplementary lines, effectively averaging down the cost of each line (though with slightly lower data quota).

It also disrupted the competition with the new Data Backpack roaming. It allows subscribers on the P70, i90, i130, UD95 and UD135 postpaid plans to use data from their existing plans in 12 selected countries, and it’s completely free. No data roaming charges, no bill shocks (provided you’re roaming on U Mobile’s preferred partners, of course).

But of course, the P70 postpaid plan was the one that had the greatest impact across the nation. It prompted swift reactions from both Digi and Celcom.

Swift Reactions

After its successful First Basic 38 plan last year, Celcom revamped its entire postpaid lineup, and removed the Optimiser feature; it was replaced by one of the two features I highlighted in last year’s article: the option to carry forward unused Internet data.

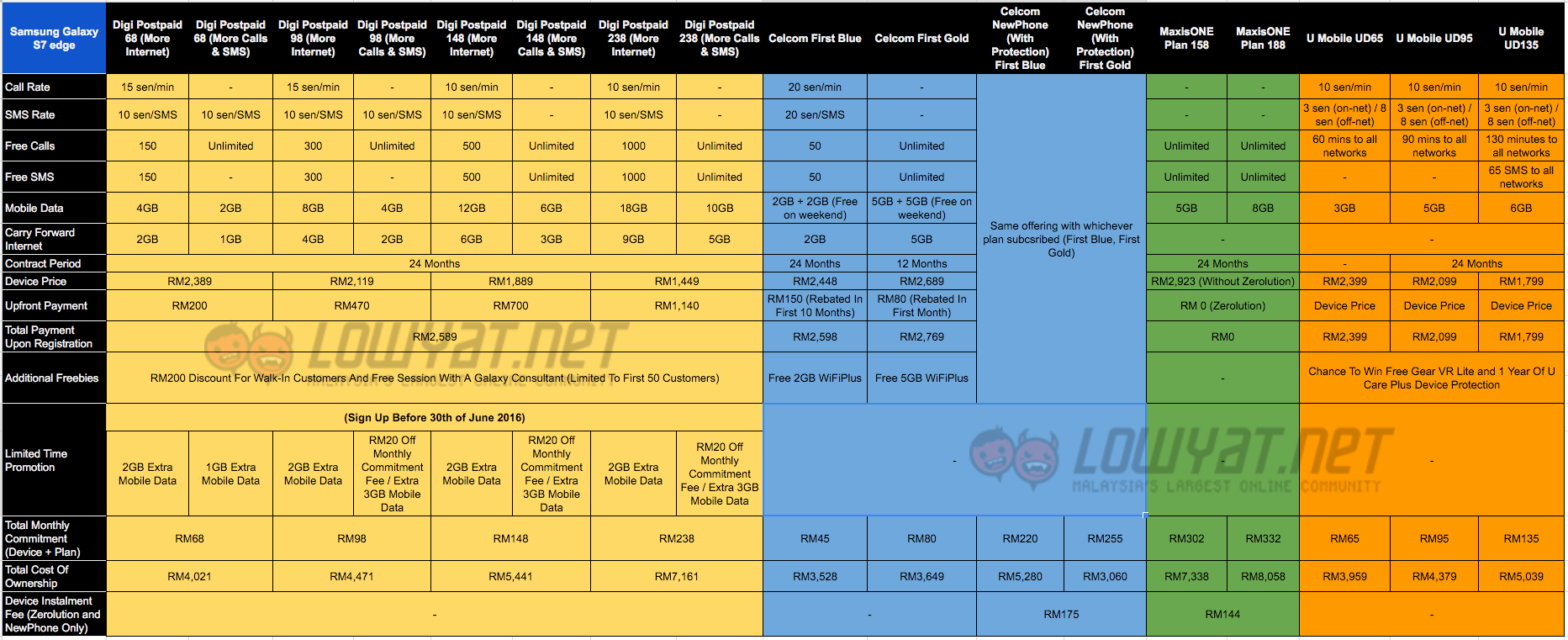

The new plans were renamed First Blue, First Gold, and the recently-announced First Platinum. Of the three, Celcom is placing plenty of resources on promoting the First Gold plan which was refreshed not long after U Mobile’s P70 was announced. For just RM80, subscribers would get 10GB of data (separated equally between weekdays and weekends), unlimited calls and texts, as well as the option to carry forward unused data. From a price perspective, it is even better than U Mobile’s P70, and arguably any other postpaid plan in the market.

The new plans were renamed First Blue, First Gold, and the recently-announced First Platinum. Of the three, Celcom is placing plenty of resources on promoting the First Gold plan which was refreshed not long after U Mobile’s P70 was announced. For just RM80, subscribers would get 10GB of data (separated equally between weekdays and weekends), unlimited calls and texts, as well as the option to carry forward unused data. From a price perspective, it is even better than U Mobile’s P70, and arguably any other postpaid plan in the market.

Digi, on the other hand, took a complicated approach. Each of its six new postpaid plans, called Digi Postpaid, can be separated into two: More Internet, or More Calls and SMS, effectively turning an already large product offering into a bloated one.

But if you take a closer look, these plans are actually pretty competitive. The plans start from just RM28 a month all the way to RM238, offering features like unlimited calls and texts, generous amounts of Internet data, and the option of carrying forward unused data.

That said, Digi also has a recently-introduced postpaid plan that is comparatively better: the Digi Postpaid 80. It is somewhat similar (and can be seen as a response) to Celcom’s First Gold: RM80 monthly commitment, 10GB data split between weekdays (7GB) and weekends (3GB), unlimited calls, and the option of carrying forward Internet data (but only up to 2GB per month).

As it attempts to increase its own user base, Digi also offers attractive sign-up bonuses – but unlike U Mobile’s limited-time 15GB promo, those who sign up for Digi Postpaid plans before 30 June 2016 will get sign-up bonuses that are valid for life (or, until you change postpaid plans, whichever is sooner). These bonuses come in the form of extra data and monthly cash rebates.

The Sleeping Giant Awakens

And, just like last year, Maxis again is the slowest to respond. Worse was to come, when controversy erupted on social media following accusations of preferential treatment to postpaid customers who were attempting to port out.

Counter offers aren’t something new – virtually all industries practise it – but the furore that came following Maxis’ official statement hurt the brand considerably, and eventually Maxis CEO Morten Lundal issued a public apology, before promising significantly improved postpaid plans.

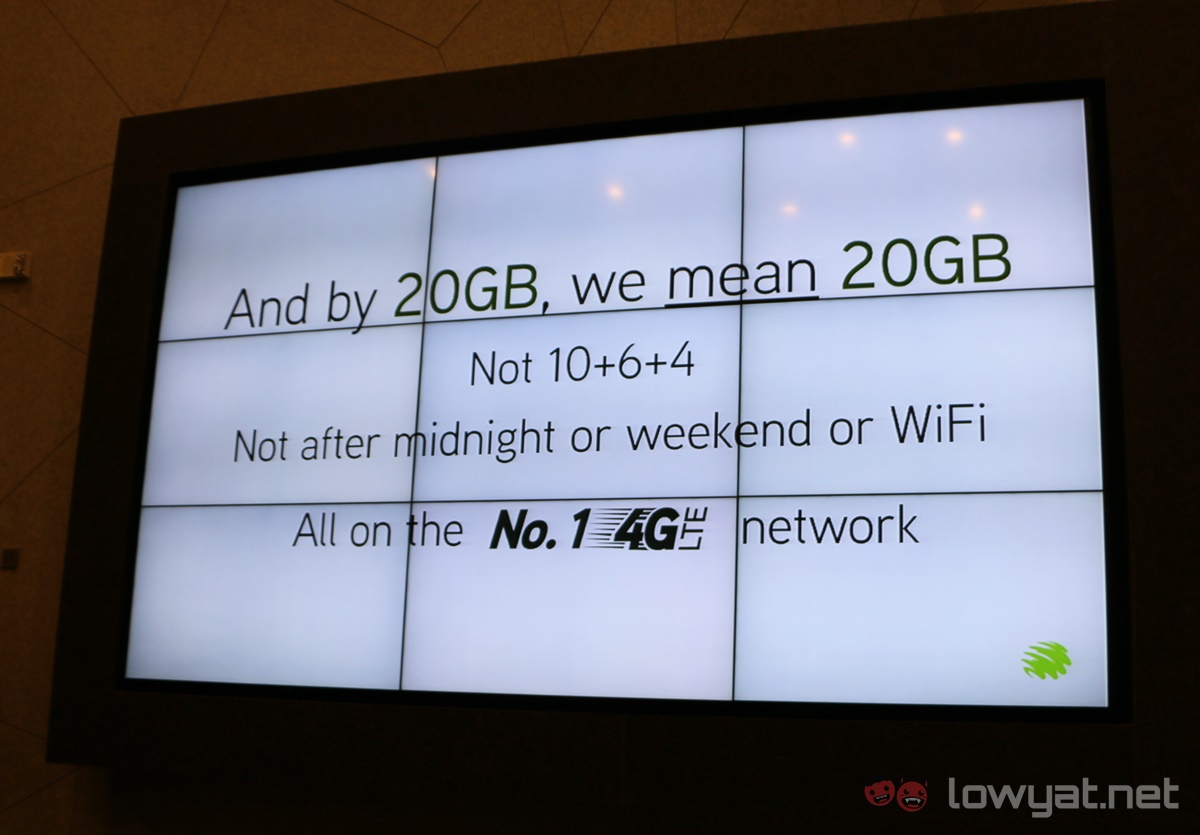

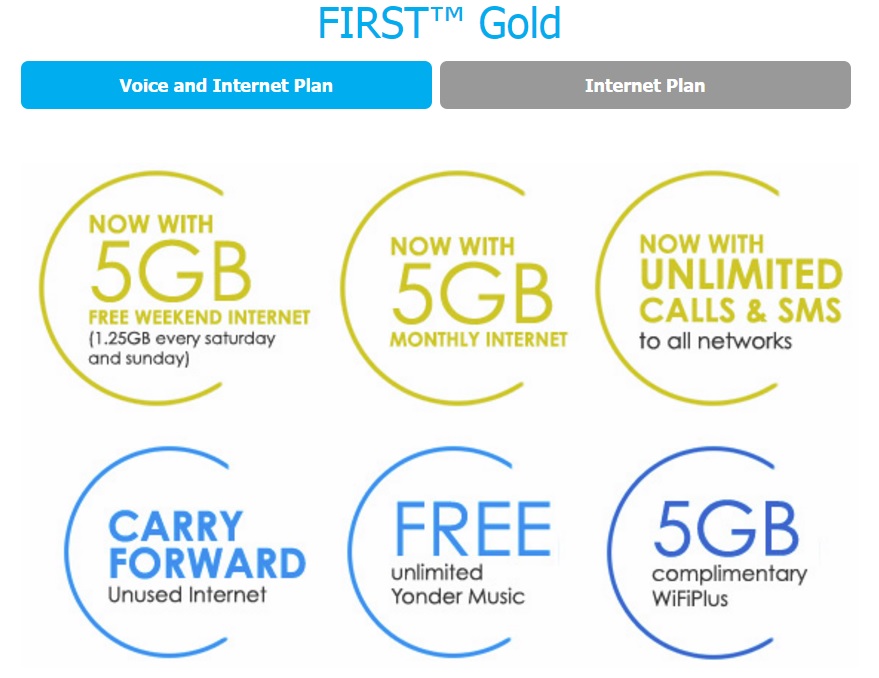

It may have been slow, but Maxis’ response would have many industry players standing up and take notice. The refreshed MaxisONE postpaid plans offer just as much data as the competition (from 5GB all the way to 20GB), with unlimited calls and texts, and the MaxisONE Share supplementary lines add 5GB of data for an additional RM48 per month which can be shared among all lines.

The company needed to address the changing consumer habits in Malaysia, while still maintaining a balance to sustain its network capital expenditures and of course, the company’s profitability. The new MaxisONE plans, according to conversations with senior Maxis staff, is a reflection of that balance point.

One-Dimensional Comparison

The new MaxisONE plans have been met with a mixed response. Most of the comments that we’ve read online slam Maxis’ new plans, labeling them to be “still expensive” due to the high point of entry – the most affordable MaxisONE plan remains priced at RM98.

As a premium provider, Maxis isn’t able to match the competition in terms of pricing. The company’s financial reports constantly show significant amounts of investments in network infrastructure (RM815 million in 2013, RM1.1 billion in 2014, and RM1.3b in 2015), with CEO Morten Lundal stating that Maxis spends “hundreds of millions” of Ringgit more on its network than the next-highest spending telco.

An interesting stat Maxis shared: the amount of data that goes through its network every month.

An interesting stat Maxis shared: the amount of data that goes through its network every month.

This statement actually isn’t as wildly exaggerated as it looks: Digi spent RM904 million in 2015, while Axiata Group spent “around RM4 billion” in network capex in its seven markets across Asia (including Celcom in Malaysia) in 2014. U Mobile isn’t a public-listed company, and as such its financial figures are not available to the public.

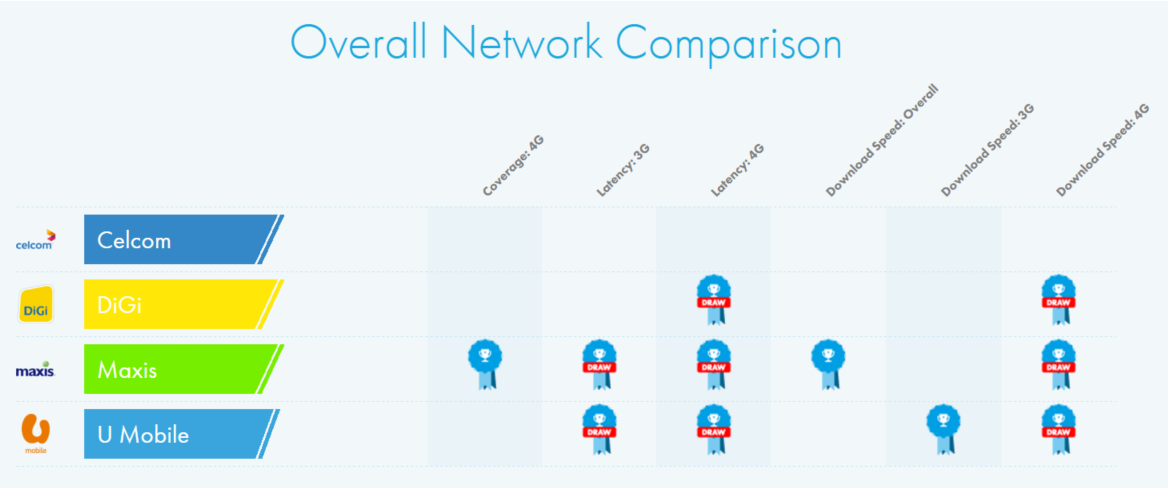

With its significant capex, perhaps it is not surprising that an independent report from OpenSignal states that Maxis has the best overall network in Malaysia.

As a price-sensitive market, Malaysia can be a tricky market to navigate. But as we concluded in our postpaid comparison post, there are many factors one should consider when choosing a postpaid plan.

Price is definitely a strong – and often determining – factor, but an informed decision should also consider network quality as well as coverage. After all, products of a higher quality, naturally, are priced higher than average ones. This meme posted earlier this month manages to describe our Malaysian telcos pretty succinctly:

Exercising Our Rights

The recent uproar over Maxis and its counter offers also opened up stirring discussions regarding customer loyalty. On one hand, loyal customers deserve some form of recognition from a brand. But on the other, the brand does not have an obligation to reward each and every loyal customer it has; after all, it isn’t exactly a reward if one is obliged to give it.

As a consumer, we can’t expect to be rewarded simply for being loyal to a brand. While it sucks to hear that some customers are offered better plans, we have every right to take our wallets elsewhere to another brand that hopefully appreciates our business. Perhaps, to a new player with plenty to prove?

Lurking in the Horizon

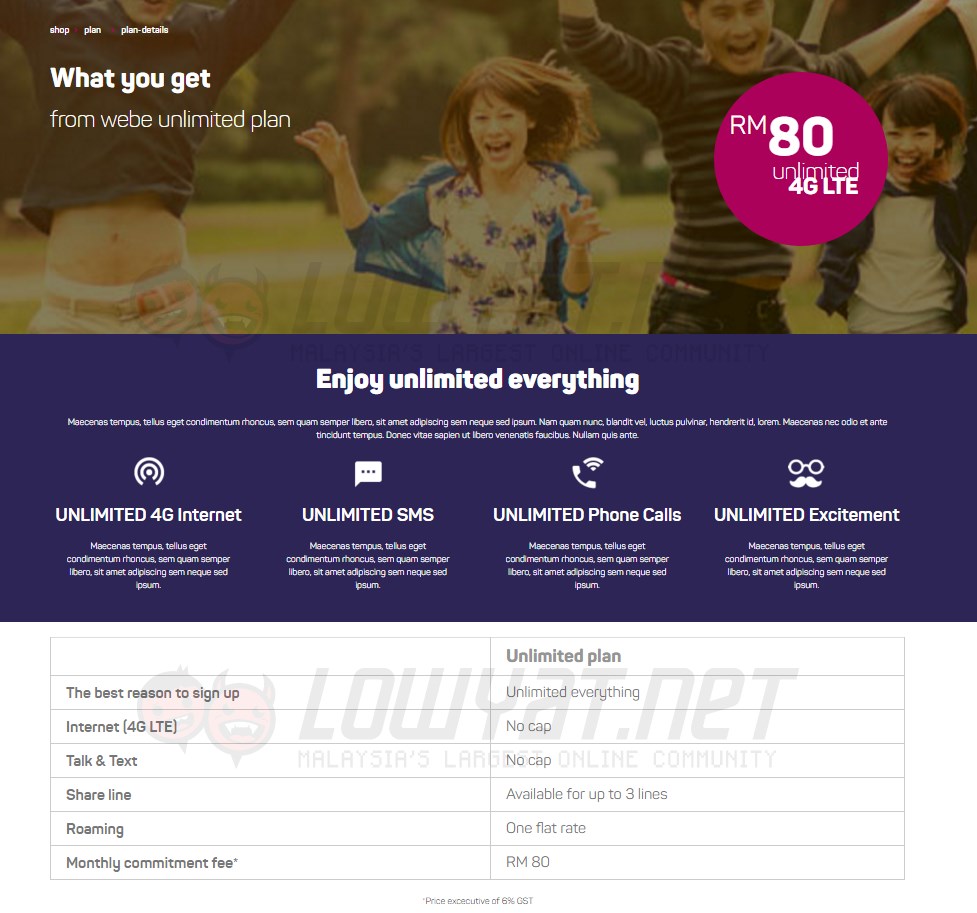

The Big Four Malaysian telcos may soon be the Big Five. webe, formerly known as P1, is set to announce itself (no, not this one) as a telco towards the middle of this year. Backed by TM’s extensive resources as well as its 4G network on the 850MHz band, webe is the dark horse all industry players are keeping a very close eye on.

After all, sources have stated that whatever we saw in the cached pages and webe’s webpage codes may have a lot of truth in them. The telco is already testing the network to selected users via a “pioneer plan” which expires at the end of July 2016, so chances are webe’s telco plans will finally be unveiled then.

In the meantime, it could be worth checking out webe’s YouTube channel, where CEO CC Puan offers some interesting insights about how telcos work.

What’s Next?

It’s a great time to be looking out for a postpaid plan. Every telco now has a data-rich plan with unlimited calls, which means you can’t really go wrong choosing any of them. Of course, we owe it to ourselves (and our hard-earned money) to go for the one that offers the best combination of value, network quality, and coverage.

That being said, there is always room for our telcos to further improve. LTE-A is around the corner, and we know all telcos have been hard at work ahead of a planned rollout this year.

With more and more postpaid plans now offering unlimited calls as a standard feature, it paves the way for a national rollout of Voice over LTE (VoLTE) for all telcos. In fact, Digi has already been testing VoLTE internally since October 2015, and confirmed its plans to launch it this year.

However, perhaps the most interesting feature I’m hoping to see become a reality this year would be a postpaid plan that offers unlimited everything. Calls, texts, and yes, even unlimited data.

This isn’t exactly an outlandish dream. In the US, T-Mobile has a postpaid plan that offers unlimited Internet, calls and texts in the US, Canada and Mexico for $95 (about RM370) a month. 3 in the UK offers all-you-can-eat data and calls for £30 (about RM170) a month.

Closer to home, we’ve already seen webe’s cached website that shows off an “unlimited everything” plan for just RM80. That figure may or may not be true, but offering this plan makes plenty of sense for webe: it builds chatter and hype, focusing all attention to this newcomer.

And of course, this will inevitably send shockwaves throughout the industry, as other players try to catch up. Another price war will erupt, driving prices down even further. Telcos will go out of their way to offer more value added services to entice you, the paying customer, to subscribe to their plans.

By next year, the Malaysian telco landscape will be completely foreign as it was compared to 2015, but one thing will remain resolutely true: the ultimate winners will be us, the consumers.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.