Malaysians woke up today with the new Goods and Services Tax (GST) applied to, well, basically almost everything. Despite that, there are still plenty of confusion among consumers: will this be more expensive after GST? Will that product’s price be the same after GST? Now that GST is finally upon us, we can finally lay to rest some of these concerns, especially with regards to the brands that are most relevant to you, our dear readers.

We’ve approached as many companies as we can, requesting more information regarding any price changes to its products to reflect the GST. This page will be updated throughout the day, so do come back if you don’t see your favourite brand listed here. You could also drop a comment if there’s a company or product we haven’t covered yet.

Telcos

Prepaid users will now be paying an extra 6% for every reload coupon. A RM10 top-up, for example, will now cost RM10.60. Companies such as Altel has broken down the cost and shared them via its social media channels.

Harga topup patut kekal selepas #myGST dilaksanakan. pic.twitter.com/6yA9CAcK3e

@kastamhq @KPDNKK— GST Malaysia Info (@gstmalaysiainfo) April 1, 2015

That being said, it appears that there is a very serious level of confusion whether consumers should be paying an extra 6% for every top-up – and it may be due to the way the taxes is explained that is causing all of this. According to the Royal Malaysian Customs, Malaysian telcos should not be adding a 6% charge for every top-up, as the reload value already contains a service tax that is being phased out for GST. Hence, there is no reason for any telco to be charging an additional 6%.

That’s not all. Prepaid starter packs are also subject to GST, so prepaid users are set to be hit harder by the new tax compared to postpaid users.

For postpaid users, the GST will replace the 6% Service Tax that has always been around and can easily be found in every postpaid user’s monthly statements. On top of that, international roaming for both data and calls are not subjected to GST. Hence, the impact of GST on postpaid users is minimal.

Gadgets

Here lies the most confusion about GST: which companies have raised its prices to reflect the 6% GST in Malaysia?

Some companies have moved swiftly to allay any confusion on post-GST prices. Xiaomi, for example, announced that only the Redmi Note 4G will see a price increase from 1 April while other products will not see a price increase. Oppo proudly announced that it will absorb all GST costs for its products, as has Vivo Malaysia.

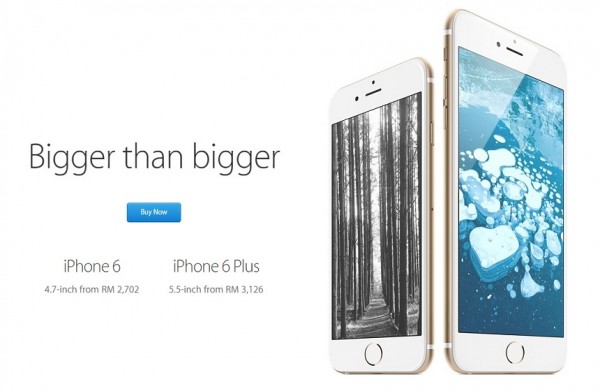

On the other hand, other companies will not be absorbing any GST costs for its products. The most notable company has been Apple, which updated its online store at the stroke of midnight to increase of all products and some of its accessories. The entire iPhone range saw a 6% price increase to reflect the new GST-inclusive prices, as have the iPad range and the MacBooks. Accessories such as the 27–inch Thunderbolt display have also seen a 6% price increase, but smaller accessories such as the Magic Mouse and the iPhone 6 Leather Case have not. Even the iPod did not see a price increase. That’s odd, because it appears Apple is absorbing the GST on smaller, lower-priced accessories but does not do so for its more expensive products.

As for HTC’s GST plans, we’ve been told that there are “currently no plans in absorbing the 6% GST” for its current products available in the market. While there are no official announcements as yet, it is likely that physical retailers will impose an additional 6% tariff on top of the retail price.

We also spoke to Asus about the impact of GST on its products, and from what we can tell…they’re not quite sure what’s going to happen either. With such a large and diverse portfolio of products, it appears the company is yet to decide on its GST plans. We’re told that some products will see the GST absorbed, while others will not. We already know that the company’s latest laptops, such as the UX305, will not have an additional 6% charge on top of its current retail price, but the rest of the products remain a mystery.

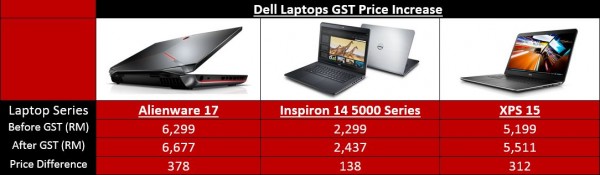

Dell has also revised the retail prices of its products on its online store to reflect the 6% tariff. From the affordable Inspiron to the high-end Alienware gaming laptops, all prices listed in the store are now inclusive of GST, where applicable. More on this story here.

As for Sony, the company has also announced revisions to the prices of its smartphones to reflect the inclusion of GST. As a result, its flagship Xperia Z3 smartphone has now gone up from RM2,199 to RM2,331, and even lower-end models such as the Xperia M2 Aqua has seen its retail price go up to RM949. The full list can be viewed here.

Finally, Samsung has already implemented the GST on the price tags of its products in its Samsung Experience Stores. Everything from the Galaxy Note 4, the Gear Circle and the Gear S have seen a 6% increase on the price tag, indicating that the prices now include the GST. That being said, the two exceptions to this will be the company’s latest Galaxy S6 and S6 edge, whose retail price tags of RM2,599 and RM3,099 are inclusive of GST.

Software & Games

If you’re an avid gamer, you’ll be happy to hear that GST is not subjected to games or software purchased on Steam, Origins and even the PlayStation Store. With all of these digital platforms not based in Malaysia, this geographical factor is likely the reason why games and software purchased on these platforms aren’t subjected to the 6% charge. However, do note that physical stores will be required by law to add the 6% tariff, so it may be a good time to go online for your gaming needs. For more information, read on here.

Services

As most will be aware, online banking, over-the-counter as well as MEPS transactions will be charged with an additional 6% tariff for GST. You can read more on that here.

If you shop online often, chances are this post-GST period will relatively be a fuss-free experience for you. Most online stores we visited earlier today have already tweaked its systems to include the GST onto the prices of each individual product that is subject to the tax. Hence, the price you see on the product page on Lazada, Superbuy, Tesco Online and even Guardian are all inclusive of GST. You’ll only see the GST charges in the breakdown at the checkout page.

If you host a website with a .my domain, you’ll also be subjected to an additional 6% charge on top of the existing subscription fees. Malay-language tech site Amanz has more on this development here.

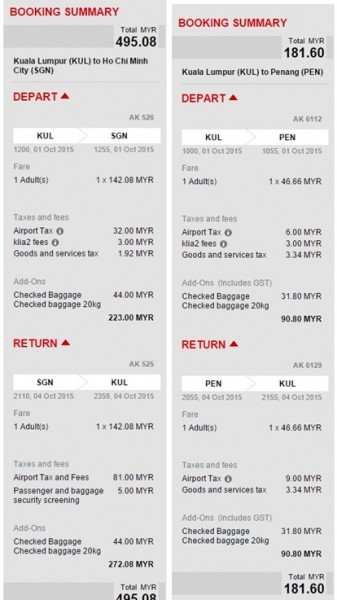

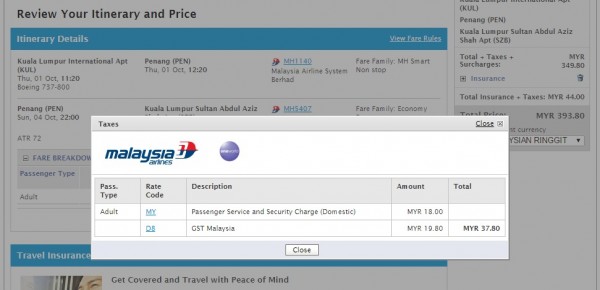

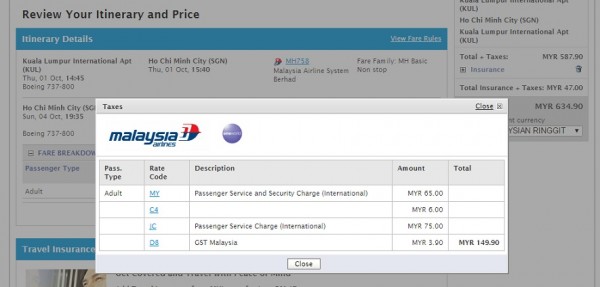

Planning to travel by plane? Here’s where things can get a little convoluted. Based on our observations on both Malaysia Airlines and AirAsia, consumers will be minimally impacted when travelling internationally, but will be hard hit when travelling locally. This is because of the rather odd GST taxation mechanism, which only adds the 6% charge on airport taxes for international flights, but adds a 6% charge for both flight tickets and airport taxes for domestic flights.

Hence, the total GST you’ll be paying for an international flight ticket will be RM3.90 for flights departing from KLIA and RM1.92 for flights departing from KLIA2.

What about everyone’s favourite taxi-replacement app, Uber? According to Divan Vasudevan, community manager for Uber KL, the company is “committed to providing safe, efficient and affordable rides for the people of KL – and there will be no increase in the fares on the Uber system for the immediate future.”

Automobiles

It looks like the biggest gainers with the introduction of GST are those looking to buy a car. Specifically, locally-assembled cars. Almost every carmaker assembling its automobiles here, such as Proton, Honda and Toyota, have announced reductions in prices ranging in four-figure sums. You can read more on this at autofreaks.com.

—-

All in all, it can be easily said that the first day of the nationwide implementation of GST hasn’t been a smooth one, and months of confusion over which products are subject to GST is still a grey area for many today. It’s even more confusing that some companies have chosen to do a noble deed by “absorbing” GST charges, while some prefer to just add GST on top of the retail price.

As consumers, that leaves us in a very unsatisfactory state in our search for clarification. However, there are channels with which we can turn to for clarifications. The @gstmalaysiainfo Twitter account contains useful information and allows consumers to ask GST-related queries directly to the proper body.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.