Now that GST has been implemented in Malaysia, will you see an increase of price on your postpaid bill? Not too much, the 6% GST will replace the 6% Service Tax on postpaid services so there shouldn’t be too much of a price difference. In addition to that, all internal roaming services provided by Malaysian Telcos will not be subjected to GST.

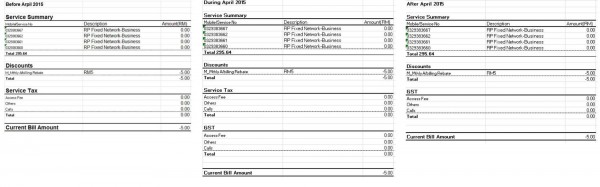

Starting 1 April 2015, all Service Tax for postpaid services from all Malaysian Telcos will be abolished and be replaced by 6% GST. However, should your account be bill in the middle of the month (consists of both March 2015 and April 2015 usage), there would be a slight complication on your bill this month as your account will be charged both GST and Service Tax. Don’t worry though, the amount will be pro-rated so at the end of the day, the total amount will remain the same.

Sample taken from Digi’s GST FAQ page

Sample taken from Digi’s GST FAQ page

GST will be charged on your all your postpaid services including voice, SMS, data, IDD calls, mobile content, monthly access fee and such. In addition to that, GST will also be charged for mobile device purchases such as tablets and smartphones, so if you’d like to buy a new smartphone from a telco, be prepared to pay 6% extra.

Finally, good news for frequent travellers. The government has classified international roaming services provided by Malaysian Telcos as “zero-rated supply”, which means that all international roaming services will not be subjected to GST.

As for prepaid services, check out our previous post for more information.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.