If you have been using PayPal to transfer personal funds to your friends and relatives, we have a bad news for you: the service will be discontinued in Malaysia very soon. Said to be taken as part of their business strategy to focus on commercial transactions, the move will take place on 4 June.

Once that date arrived, PayPal users in Malaysia will not be able to make personal payments to either local or oversea users. That being said, Malaysian PayPal users will still be able to receive personal payments from users in markets where Personal Payments service is still available.

The discontinuation of the PayPal’s Personal Payments service is indeed identical to what happened in Singapore back in February although over there it was due to regulatory requirements rather than strategy alignment. For further clarification, check out the media statement and brief FAQ that PayPal have sent to us through the Read More link below.

As PayPal focuses on its business strategy of enabling secure and convenient commercial transactions in Malaysia, the Personal Payments service will no longer be available to users in Malaysia from 4th June 2013.

PayPal’s mission is to connect merchants of all sizes to millions of consumers around the world, creating more economic opportunity for individuals, businesses and communities. As such, we would like to assure our users in Malaysia that they will still be able to use PayPal for commercial activities. For example, users can still shop and pay with any local or overseas PayPal merchant and receive payments for the sale of goods and services from any local or overseas buyer with a PayPal account.

We sincerely apologise for the inconvenience caused to users in Malaysia who are affected by this change.

1. Why is the Personal Payments service being discontinued?

As PayPal focuses on our business strategy of enabling secure and convenient commercial transactions in Malaysia, the Personal Payments service will no longer be available to users in Malaysia from 4th June 2013. PayPal’s mission is to connect merchants of all sizes to millions of consumers around the world, creating more economic opportunity for individuals, businesses and communities.

2. What is the Personal Payments service used for?

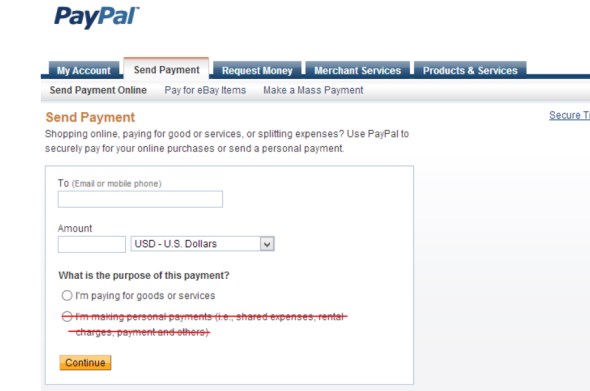

The Personal Payments service was offered to our users in Malaysia to facilitate payment of rental charges, shared expenses, or payments owed.

3. Will I be able to send personal payments to other PayPal users living outside of Malaysia?

No, unfortunately you would no longer be able to make personal payments to users both in Malaysia and overseas.

4. Will I still be able to receive personal payments from other PayPal users outside of Malaysia?

You can still receive funds sent from other PayPal users outside of Malaysia, consistent with the availability of this PayPal service in the country where the user is located.

5. I have a Personal account. Does the removal of the Personal Payments service mean I will not be able to send payments for items I want to purchase?

Regardless of whether you have a Personal, Premier or Business account, you will continue to be able to shop online and use the PayPal services for the commercial payment of goods and services. Only the Personal Payments service has been discontinued.

6. Will it be possible for me to send payments to a merchant for a purchase of goods and service?

Yes, you can make payments to merchants in Malaysia as well as in other countries for the purchase of goods or services.

7. I’m a merchant. Will it be possible for me to receive payments from international buyers?

Yes. Merchants can still receive commercial payments for sale of goods and services from both international and Malaysian buyers.

8. Because of the nature of my business, I don’t have an online website. Will it be possible to receive payments from customers using PayPal for the sale of goods and services provided by me?

Yes, if you are collecting payments in exchange for goods or services, your customers will still be able to make payments for your services through PayPal.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.