You know how there are fancy little credit/debit card readers that plugs into a mobile device, allowing businesses to have an affordable, convenient and mobile card reader that leverages on modern technology? Well, it looks like it has arrived in Malaysia thanks to collaboration between DiGi and CIMB Bank. Yesterday, both companies signed a partnership to offer Malaysia’s first ever mobile card payment system. The collaborative effort with CIMB Bank and its Plug and Pay solution paves the way for DiGi to enable credit and debit card payment facilities on the go for its SME and enterprise business customers from as low as RM20/month.

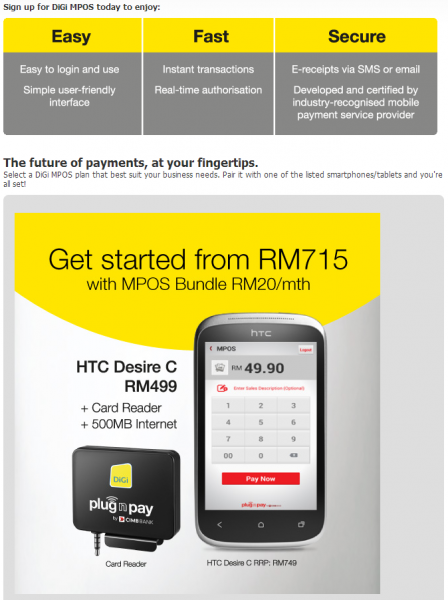

SME and enterprise owners can now sign up at DiGi’s website at www.digi.my/mpos. The telco is offering the deal with it’s the MPOS plan, which consists of a full-packaged Android device and EMV card reader for RM715, and a monthly commitment of RM20/month. The package comes with a HTC Desire C but customers are free to upgrade devices and internet plans in addition to the option to bundle voice services, depending on their needs.

“This new innovation offers fast, easy and secure payment platform leveraging on mobile connecitivity. We believe that mobile internet empowers societies and is a powerful catalyst for business. This is reflective of our continued effort to bring relevant services that help business customers harness the power of the internet for improved efficiencies and growth while benefiting their respective customers.” – Albern Murty, Chief Marketing Officer of DiGi.

As for consumers, you don’t have to be worried about receiving your receipts, according to DiGi, the MPOS system comes with instant transactions and real-time authorizations, and e-receipts will be sent via SMS or email.

Visit DiGi to find out more.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.