Dell might just consider an Initial Public Offering (IPO) as one of its many strategic options, as the company seeks out ways to bolster its revenue stream.

Five years after its founder, Michael Dell, took the Texas-based company private, Dell is now trying to raise some much needed funds to both further expand the company, and to help pay off its burgeoning debt, which according to Bloomberg, currently sits at US$46 billion (~RM178 billion).

This includes a bond of US$3 billion (~RM11.6 billion) maturing this year, and another set of bonds worth US$4.35 billion (~RM16.86 billion) next year.

Still on the subject of IPOs, Dell might also consider holding a public share sale of its own cloud-computing venture, Pivotal Software Inc., simply because a discussion between the company and its bankers suggested that Pivotal could fetch between US$5 billion (~RM19 billion) and US$7 billion (~RM27 billion).

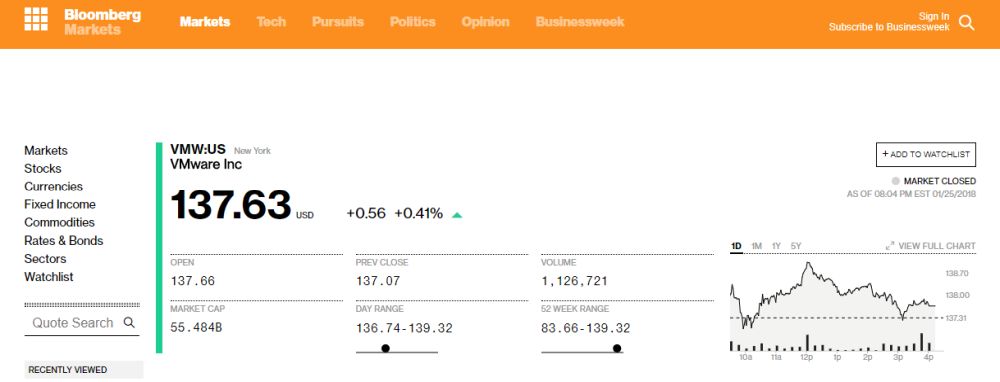

Dell’s options aren’t just limited to dishing out IPOs. It’s also considering procuring the rest of VMWare shares that it doesn’t already own, considering that its shares have risen more than 60% in the last year, and a full acquisition of the company would technically be more profitable for Dell.

Dell’s options aren’t just limited to dishing out IPOs. It’s also considering procuring the rest of VMWare shares that it doesn’t already own, considering that its shares have risen more than 60% in the last year, and a full acquisition of the company would technically be more profitable for Dell.

As a quick recap, VMWare is a data-center software vendor that is a part of EMC Corp., a storage-technology provider that Dell procured back sometime in 2016. It is well-known for being able to provide desktop virtualisation and cloud computing services to its clients around the world.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.